BTC Price Prediction: $125K in Sight as Institutional Demand Meets Technical Breakout

#BTC

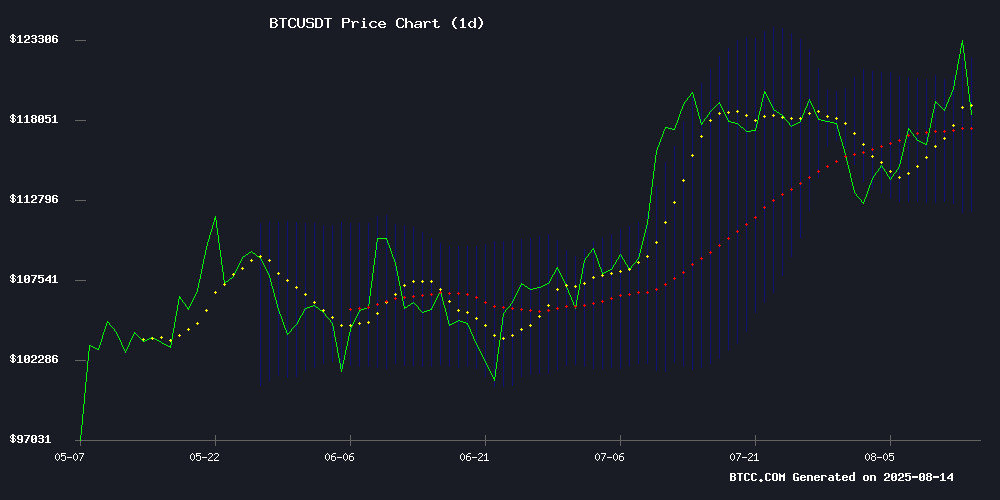

- Technical Breakout: BTC price sustains above 20MA and tests Bollinger upper band, signaling upside potential.

- Institutional Catalysts: Top 100 firms now hold 951,323 BTC, with SpaceX's $1B position exemplifying corporate demand.

- Macro Tailwinds: Fed rate cut hopes and Samson Mow's $1M BTC prediction amplify bullish sentiment despite short-term volatility.

BTC Price Prediction

BTC Technical Analysis: Bullish Momentum Builds Above Key Moving Averages

BTC is currently trading at, firmly above its 20-day moving average (117,255.68), signaling bullish momentum. The MACD histogram remains negative (-865.62), suggesting short-term consolidation, but the price hugging the upper Bollinger Band (122,721.19) indicates potential upside. According to BTCC analyst James, 'A sustained close above 122,700 could trigger a rally toward 125,000, with the middle band (117,255) acting as strong support.'

Market Sentiment: Institutional Demand and Macro Hopes Fuel BTC Rally

Bitcoin's surge to new all-time highs ($123,600) aligns with bullish catalysts: institutional holdings (951,323 BTC among top 100 firms), Fed rate cut expectations, and SpaceX's $1B BTC treasury. However, James notes caution: 'The Rada's rejection of crypto reserves in Ukraine and profit-taking near 124,457 may cause short-term volatility. Altcoin divergence (per Samson Mow) could temporarily siphon capital from BTC.'

Factors Influencing BTC’s Price

Bitcoin Briefly Surpasses Alphabet’s Market Cap Amid Rally

Bitcoin's market capitalization eclipsed Alphabet Inc.'s for the second time this year as its price surged to a record $124,457. The cryptocurrency now ranks as the sixth most valuable asset globally, trailing Apple by $36 billion in market value.

The digital asset's volatility was on full display as it retraced to $121,718 after the peak, allowing Alphabet to reclaim its position. Market observers note Bitcoin requires just $2 billion in additional capitalization to overtake the tech giant again.

Ukraine's Rada Rejects Draft Law on Crypto Reserves Amid NBU Opposition

Ukraine's Verkhovna Rada will not advance a draft law proposing the inclusion of cryptocurrencies in national reserves, following opposition from the National Bank of Ukraine (NBU). Committee Chairman Danylo Hetmantsev cited the NBU's concerns over crypto volatility as the primary reason for the decision.

The legislative proposal, introduced in June by MP Yaroslav Zheleznyak and colleagues, sought to permit—but not mandate—the NBU to hold Bitcoin and other virtual assets as reserve assets. This aligns with recent rejections of similar measures by the European Central Bank and Swiss National Bank.

Market observers note the setback reflects persistent institutional skepticism toward crypto's role in sovereign finance, despite growing adoption in private markets. The draft law's failure underscores the regulatory gap between progressive crypto legislation and traditional monetary policy frameworks.

Bitcoin Faces Divergent Paths Amid Altcoin Rally, Says Samson Mow

Bitcoin surged to a new record high above $123,000, but its trajectory remains uncertain, according to Jan3 CEO Samson Mow. The cryptocurrency pioneer outlined two starkly different scenarios for BTC: a dramatic 'Godzilla' surge that would drain liquidity from altcoins, or a broader market selloff triggered by overheating altcoin mania.

In a bullish scenario, Mow predicts Bitcoin could 'Omega up,' absorbing capital from the broader crypto market and causing altcoins to plummet 30-40%. The alternative path sees altcoin euphoria peaking, leading to a cascading selloff that briefly drags Bitcoin down before it recovers dominance.

The total crypto market capitalization reached $4.26 trillion as Bitcoin gained 3.5% today. Mow's analysis suggests the market stands at an inflection point, where either Bitcoin reasserts its dominance or undergoes short-term volatility before ultimately decoupling from altcoins.

Top 100 Public Companies Now Hold 951,323 BTC as Institutional Demand Soars

The top 100 public companies now collectively hold approximately 951,323 BTC, reflecting a surge in corporate Bitcoin adoption. This marks a significant increase from previous periods, with 15 companies expanding their holdings in just the past week. Bitcoin's price stands at $123,140, with a market capitalization of $2.3 trillion.

Leading the pack is Strategy Inc. (formerly MicroStrategy) with 628,946 BTC, followed by Marathon Digital Holdings and Twenty One Capital. Recent acquisitions, such as Metaplanet and Smarter Web's $100 million investment, underscore growing institutional interest. UK-based Vaultz Capital also added 17.15 BTC to its reserves.

Who is Cashing Out of Bitcoin at Record Highs Above $120K?

Bitcoin's rally has stalled above $120,000 since mid-July, with prices peaking at $124,157 before retreating to $123,000. The lack of upward momentum suggests significant selling pressure, particularly from long-term holders.

Blockchain data reveals that wallets dormant for over a decade have suddenly become active, liquidating holdings. Gabriel Halm of Sentora notes that long-term holders are accelerating their sales, a shift from historical patterns where selling phases were more predictable.

According to Bitcoin Magazine, the supply held by long-term wallets—those retaining coins for at least 155 days—has dropped by over 300,000 BTC in four weeks. Glassnode confirms this trend, though the pace of profit-taking has slowed since July.

Bitcoin Price Today Hits New ATH at $123,600 on Fed Rate Cut Hopes

Bitcoin surged to a record $123,600 as traders priced in a potential Federal Reserve rate cut in September. Cooling inflation data, now at 2.7%, fueled speculation of a 50 basis-point reduction—a move that could unleash fresh liquidity into risk assets. US Treasury Secretary Scott Bessent's comments added momentum, with Santiment marking the milestone as a testament to Bitcoin's 17-year evolution.

The prospect of looser monetary policy has turbocharged institutional adoption. Bitcoin's market capitalization now eclipses Google and Amazon, ranking as the world's sixth-largest asset. MicroStrategy's holdings reached $77.2 billion, while El Salvador's national treasury sits on $468 million in unrealized profits. A 5,400 BTC whale withdrawal from Kraken—valued at $656 million—signaled strong accumulation trends, likely bound for cold storage.

SpaceX Bitcoin Holdings Surpass $1 Billion Mark

SpaceX now ranks among the world's largest corporate holders of Bitcoin, with Arkham Intelligence data revealing holdings of 8,285 BTC valued at over $1 billion. The aerospace company initiated its Bitcoin acquisitions on December 31, 2020, with its most recent purchase occurring on June 10, 2022.

Notably, SpaceX has maintained its Bitcoin position without significant divestment—a holding strategy mirroring MicroStrategy's famous diamond-handed approach. This substantial treasury reserve coincides with Bitcoin's maturation as a corporate reserve asset, particularly among tech-forward enterprises.

Bitcoin Smashes New All-Time High at $124,457 – Can It Hit $125K Today?

Bitcoin surged to a record $124,457, propelled by spot ETF inflows, whale accumulation, and heightened on-chain activity. Trading volumes spiked globally, reflecting institutional confidence and retail participation. Network metrics show active addresses at multi-month highs, reinforcing bullish momentum.

Liquidity pools deepen near resistance levels as buyers dominate order books. With macro tailwinds and limited sell pressure, the $125,000 threshold appears achievable if U.S. session momentum holds. Market depth improvements across exchanges suggest sustained demand at current valuations.

Bitcoin Price Surges Past $123K as Rally Targets $125K

Bitcoin surged to a fresh record high, breaching $123,824 on Coinbase before settling near $121,100 in late trading. The cryptocurrency now eyes the psychologically significant $125,000 level, buoyed by softer-than-expected US inflation data. July's CPI rose 2.7% annually, aligning with June's figure and slightly below forecasts, amplifying expectations of a Federal Reserve rate cut in September to nearly 94%.

Institutional demand remains a cornerstone of the rally. US-listed Bitcoin ETFs have attracted $1 billion in net inflows over five days, with BlackRock's IBIT fund leading at $111 million on Tuesday alone. Total Bitcoin ETF exposure now exceeds $153 billion, while Ethereum ETFs have also seen robust inflows, including a $1 billion single-day surge.

The broader crypto market mirrors this momentum, with total capitalization climbing 2.84% to $4.17 trillion. Corporate activity adds fuel, as Japan's Metaplanet recently acquired 518 BTC for $61.4 million, underscoring growing institutional adoption.

Samson Mow Predicts Bitcoin Will Reach $1 Million Per Coin

Samson Mow, CEO of JAN3, has issued an ultra-bullish prediction for Bitcoin, forecasting a potential rise to $1 million per coin. His argument hinges on Bitcoin's unparalleled scarcity and decentralized nature, which he believes will drive its value exponentially higher. "Everything is trending to zero against Bitcoin," Mow declared, reinforcing his maximalist stance.

With over 19 million BTC already mined out of a fixed 21 million supply, Mow emphasizes Bitcoin's deflationary design as a key differentiator from altcoins. This scarcity, combined with growing institutional adoption—exemplified by El Salvador's Bitcoin-friendly policies—forms the core of his thesis. The prediction aligns with views shared by other Bitcoin maximalists like Max Keiser.

CryptoAppsy Simplifies Market Navigation with Real-Time Data and Portfolio Tools

CryptoAppsy emerges as a vital tool for traders navigating the 24/7 cryptocurrency markets. The mobile application delivers real-time price tracking across thousands of assets—from Bitcoin's $121,753 valuation to emerging altcoins—with latency under milliseconds. Its exchange-agnostic architecture aggregates global data streams, enabling arbitrage opportunities and trend analysis.

Portfolio management features allow manual position tracking without account creation, while customizable alerts notify users of threshold breaches. The platform distinguishes itself with institutional-grade charting tools, including historical price visualization and favoriting mechanisms for focused asset monitoring.

How High Will BTC Price Go?

James projects a short-term target of 125,000 USDT, citing these key levels:

| Indicator | Value | Implication |

|---|---|---|

| Price vs. 20MA | +3.96% above | Bullish trend intact |

| Bollinger Upper Band | 122,721.19 | Breakout threshold |

| MACD Signal Line | 1,156.18 | Long-term bullish |

Risks include profit-taking near ATHs and altseason rotation, but institutional accumulation (e.g., SpaceX) may dampen downside.